Taxation

WITHOLDING TAXES

The GCR/RV is clearly the once-in-a-lifetime global debt jubilee, thus there’s little doubt government’s worldwide have updated taxation laws to collect their portion of our windfall. That said, it is wise to expect traditional Capital Gains taxation (short-term 1 year or less, long-term 1 year + 1 day). Although, a flat tax or “Historical Asset Tax” may ultimately be assessed on GCR/RV redemption currencies, and range anywhere from 14% to 20% at the Federal level.

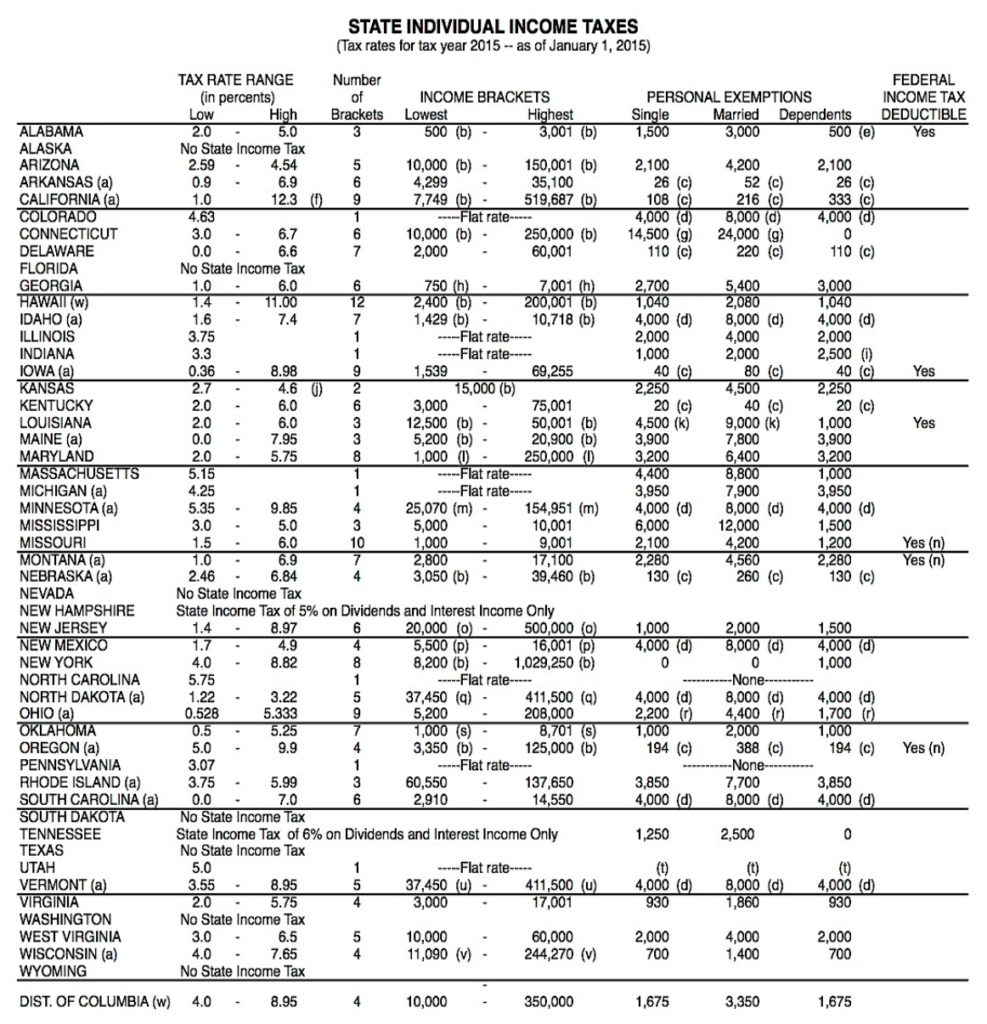

At the State level, taxation will more than likely be assessed per existing tax laws, and largely dependent upon personally reported income (see 50 State chart below):

Whatever your final tax rate, be sure to save a healthy portion of your profits specifically for eventual tax exposures (which you’ll be paying on a quarterly versus annual basis now), and always make sure you consult with your accountant or CPA as soon as possible to determine how best to move forward in a legal and ethical manner, so you can quickly pay your fair share but not a penny more.

Look, nobody wants to pay taxes, but everybody seems to end up doing so in the end; just keep in mind it’s far more important that you sleep well at night versus stressing out over ROI’s or profit maximizations, given how fortunate you were to receive these kinds of returns in the first place.

Just keep everything in perspective and remember to enjoy the GCR/RV process… including the taxation portion of it.