Gold Standard

OLD BENCHMARK VALUE

To understand how and why currencies historically redeem, it’s wise to first look at the base monetary value and how that standard is assigned. First, one must look at the intrinsic universal value of gold historically, and accept that gold is now, and has always been a currency. Also, consider that all in-ground assets, including oil, gems, minerals, and precious metal are all traded like currency since the beginning of modern commerce.

Meaning, just as physical gold bullion or coins were once was traded for everyday goods like we do today with paper or digital currencies, in theory, that never stopped. In fact, the new gold standard will see individuals exchanging physical gold for actual goods and services, including transactions between governments.

This is why the world going back to the old gold benchmark is so dramatic, and why it had to become the new benchmark by which all value is measured, as opposed to Central Bank issued notes, sovereign bonds, banking instruments, derivatives, credit cards and local fiat currencies. They insurmountable debt those fiat philosophies created were crippling, irresponsible and immoral.

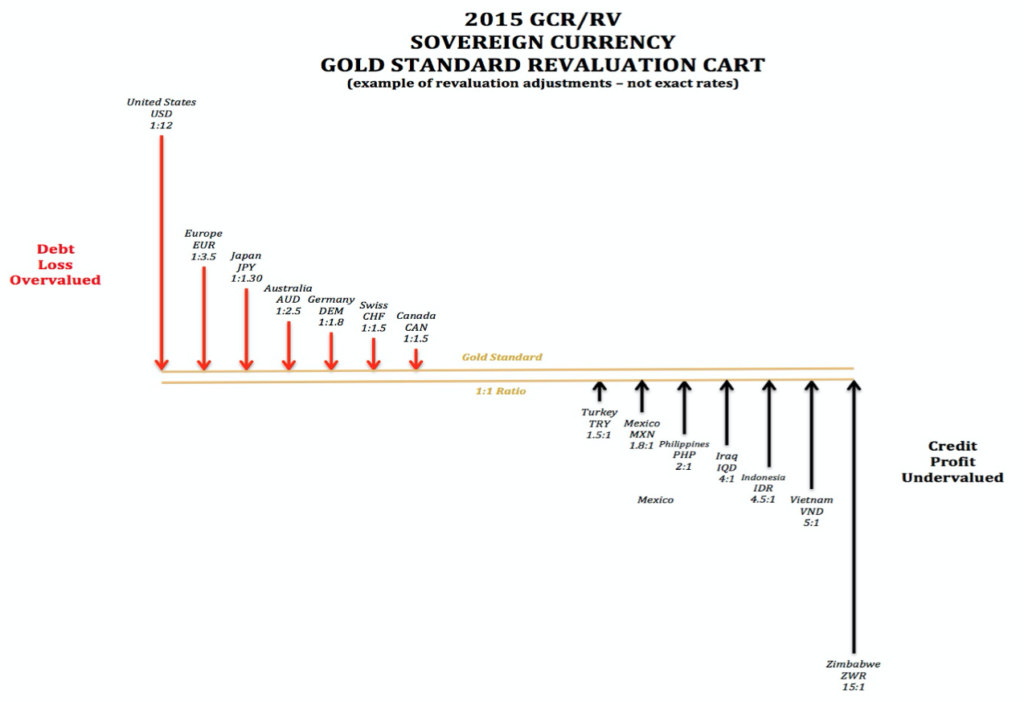

Thus, every monetary unit of value now has a real equity relationship to gold, with all either moving towards or away from the gold standard’s 1:1 ratio. Thus, the citizenry of the world is again playing on a level economic playing field.

However, to achieve such global harmony, all currencies must first adjust or “revalue” to an accurate and equitable gold standard. Some currencies will do so publically and immediately—and be in a “first basket of revaluations” such as the Iraq Dinar, Vietnam Dong, Zimbabwe Dollar and Indonesian Rupiah. While others will gradually and quietly transition as to not upset the masses or global money supply algorithms.

Once a currency is adjusted or is revalued, an arbitrage is created within exchangeable value or price; thus creating economic opportunity for any one whom physically holds such an adjusted sovereign debt instrument; and should they desire to redeem the currency in a bank, they can receive the difference as profit… or loss depending on which currency is held.

Now it is true some currencies will revalue up, while others will revalue down. And a few will even collapse and need to be taken out of circulation slowly like the ECB’s Euro and Federal Reserve’s USD; some are most certainly to spike much higher, like the Zimbabwe Dollar, which is scheduled to revalue as many as fifteen decimal places since 2009. Yet in the end, most will ultimately readjust unnoticed, with a select few not adjusting at all because they never left the gold standard measurement of value.

To better illustrate how international sovereign currencies of the world will move in relation to gold’s updated value, below is a graphic that visually shows the distance a currency must travel in order to unify with the current fair market value of gold.